Participate in the evolution of online payments. DPMax is an easy add-on solution that guarantees an increase in market share, improved conversion rates, and revenue. We provide the most comprehensive bank coverage across Europe, ensuring 100% coverage and full redundancy. With DPMax, payments are endless thanks to the thousands of European banks in our system.

We are offering access to the largest European Payment Methods. Unlock the largest & latest European payment solution with DPMax. Benefit from comprehensive PSD2 coverage and future global expansion opportunities through a leading provider.

Simplify complex infrastructure with our turnkey integration solutions.

Focus on building market-defining products while we handle the rest.

Integrate DPMax with these options:

The term “open banking” describes an extremely secure and high-technology procedure. Banks are sharing various data with regulated third-party service providers. Through open banking, banks provide access to consumer banking, transaction data, and other financial information. This data is then shared via secure APIs. Open banking aims to improve financial services for consumers and merchants. Providing this data that banks have historically kept in-house creates endless new opportunities in the world of payments.

Open banking enables payment businesses, whether new or well-established, to enter the market and offer new and innovative products that benefit both consumers and merchants. It’s important to note that all mentioned data is only shared with the customer's permission. Open banking is regulated by the PSD2 or the Revised Payment Services Directive – a regulatory EU legislation that defines the application of open banking.

learn more about open bankingWith the introduction of the Payment Service Providers Directive (PSD) in 2007, contributed to the development of a single payment market in the European Union with the goal to promote innovation, competition, and efficiency within the EU.

In 2013, the European Commission proposed an amendment to enhance these objectives. It aims to strengthen security in the payments market, improve consumer protection, and increase competition and innovation in the sector. With these enhancements, it should be expected to facilitate the development of new methods of payment and e-commerce. The payments industry is changing and innovating thanks to PSD2.

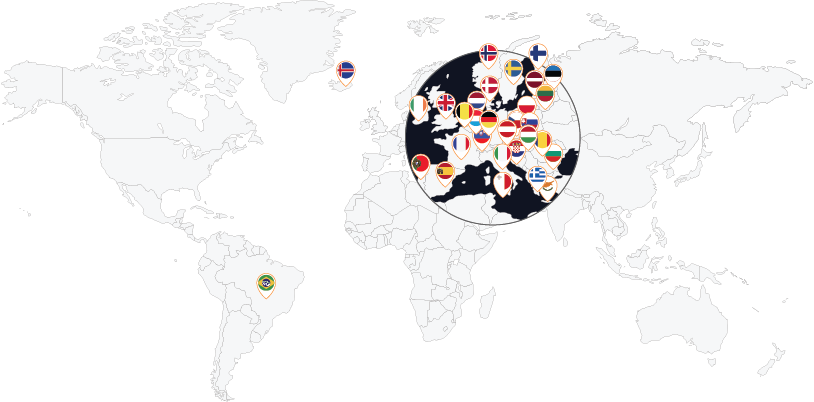

Supported countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

We can say that we can offer 100% coverage as our system has secondary underlying systems built into its core, which means if a bank is not part of the open banking system yet, our system switches to a payment method that supports all EU banks.

Integration is simple via API, Hosted Payment Page, Payment Widget.